employee from 01.01.2017 to 01.01.2025

Vladikavkaz, Vladikavkaz, Russian Federation

VAK Russia 5.2.1

VAK Russia 5.2.4

VAK Russia 5.2.5

VAK Russia 5.2.6

VAK Russia 5.2.7

UDC 658.1

Small enterprises play a key role in the economic development of the country. In 2024, there is an increase in the number of small and medium-sized entrepreneurs, but financial difficulties and high tax rates create significant obstacles to their development. In this regard, tax optimization is becoming an important tool for ensuring financial stability and competitiveness of companies. The purpose of this study is to analyze the impact of tax optimization on the financial stability of small companies, identify effective tax planning methods, and develop recommendations for improving business financial performance. Materials and methods. The study used scientific articles and statistical data from open sources such as the Federal Tax Service and the Federal State Statistics Service. The methods of content analysis and comparative analysis were used. Results and discussions. The study showed that tax optimization includes legitimate optimization methods and illegal schemes. Legitimate methods such as tax planning and the use of tax incentives help businesses minimize tax liabilities. At the same time, illegal methods such as business fragmentation can lead to serious legal consequences. Determining the optimal tax regime and proper management of the tax base play an important role in improving the financial stability of small companies. The author offers recommendations aimed at optimizing tax planning. Conclusions. Tax optimization is an important tool for ensuring the financial stability of small businesses. Effective tax planning and the use of legitimate optimization methods can significantly increase the competitiveness of a business.

tax optimization, financial stability, small companies, tax regulation, financial indicators, economic analysis, case method, content analysis, statistical data, small business management

Введение

Малые предприятия играют важную роль в экономическом развитии страны. Они создают новые рабочие места и способствуют внедрению рыночных инноваций, что, в свою очередь, стимулирует экономический рост государства [1]. В 2024 году число субъектов малого и среднего предпринимательства (МСП) достигло 6 589 тыс. ед., что на 3,8 % больше, чем в предыдущем году. Кроме того, наблюдается рост числа самозанятых граждан, число которых составило 12 172 тыс. ед., что на 31,02% больше, чем в 2023 году [2].

Финансовые трудности, жесткая конкуренция и высокие налоговые ставки создают серьезные препятствия для развития малого бизнеса. В связи с этим, грамотная оптимизация налоговых платежей позволяет малым предприятиям сохранять финансовую стабильность и конкурентоспособность на рынке [3].

Оптимизация налогообложения представляет собой комплекс законных мер, направленных на минимизацию налоговых обязательств для предприятий [4]. Исследователи в области финансов продолжают изучать взаимосвязи между методами оптимизации налогообложения и показателями устойчивости малого бизнеса. Ильясов Д. М. отмечает, что налоговое законодательство Российской Федерации предоставляет малому и среднему бизнесу широкий спектр инструментов для оптимизации налогообложения. Тем не менее, многие из этих возможностей остаются невостребованными или игнорируются [5]. В исследовании, проведенном Полянской М.В. и соавторами, отмечается важность соблюдения законодательства при проведении налоговой оптимизации [6].

Малый бизнес часто сталкиваются с неопределенностью в разграничении законных методов налоговой оптимизации и незаконных схем минимизации налогообложения. В связи с этим, предпринимателям необходимо иметь четкое представление о существующих рисках и юридических последствиях нарушения налогового законодательства для обеспечения стабильного развития бизнеса и предотвращения административных взысканий [7]. Таким образом, все вышесказанное подчеркивает актуальность данной темы исследования.

Следовательно, цель данного исследования — проанализировать влияние налоговой оптимизации на финансовую стабильность малых компаний, определить эффективные методы налогового планирования, а также разработать рекомендации, которые могут способствовать улучшению финансовых показателей и повышению конкурентоспособности бизнеса в условиях современного экономического регулирования.

Материалы и методы

В рамках данного исследования была проанализирована роль налоговой оптимизации в повышении финансовой устойчивости малых компаний. Для этого использовались различные материалы и методы. Основным источником информации послужили научные статьи и исследования, посвященные налоговому законодательству, финансовой устойчивости и специфике управления малым бизнесом. Эти материалы позволили глубже понять, как налоговая оптимизация может способствовать улучшению финансовых показателей малых компаний. Также были собраны статистические данные о налоговых поступлениях и финансовых результатах деятельности малых компаний из открытых источников Федеральной Налоговой Службы РФ и Федеральной службы государственной статистики РФ.

Для анализа собранной информации был применен метод контент-анализа. Он позволил исследовать существующую литературу и документы, касающиеся роли налоговой оптимизации в финансовой устойчивости. Кроме того, был проведен сравнительный анализ данных, который позволил выявить влияние различных методов налоговой оптимизации на финансовые показатели малых компаний.

Результаты и обсуждения

Виды налоговой оптимизации можно разделить на две группы, к которым относится налоговое планирование и уклонение от уплаты налогов.

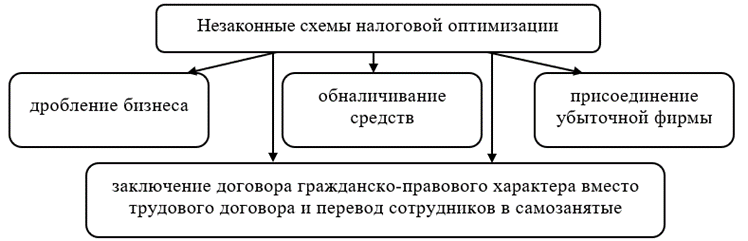

Незаконные методы оптимизации налогов представлены на рисунке (рис. 1). Минимизация налогового бремени посредством противозаконных методов оптимизации представляет серьезную угрозу экономической безопасности государства, вследствие чего данная практика категорически неприемлема при формировании финансовой стратегии предприятия.

Рис. 1. Незаконные методы оптимизации налогов

В рамках метода «Дробление бизнеса» некоторые руководители создают несколько компаний на основе одного Общества с ограниченной ответственностью (ООО) с целью обойти ограничения по выручке, установленные для специальных налоговых режимов, сохранить статус малого или среднего предприятия и снизить налоговую нагрузку. Однако, если такие организации не имеют собственных источников дохода и направляют всю прибыль в другие юридические лица, Федеральная налоговая служба (ФНС) может обнаружить фиктивное дробление бизнеса и применить соответствующие штрафные санкции. За незаконное дробление бизнеса компаниям, помимо доначисленных налогов, придется уплатить штраф в размере 40% от суммы доначислений (п. 3 ст. 122 НК) [8].

ИП имеют право использовать средства с расчетного счета для личных нужд и снимать наличные деньги через банкоматы, однако для ООО этот процесс более сложный. В определенных ситуациях юридические лица могут прибегать к использованию схем, направленных на обналичивание денежных средств. К примеру, создаются фирмы-однодневки, с которыми затем заключается договор, и денежные средства переводятся на их счет в рамках фиктивной сделки с целью вывода средств. Также одним из способов уклонения от уплаты налогов является присоединение убыточной фирмы. Если экономические потери одной организации переходят к другой, это может привести к снижению налоговой базы. Однако если налоговая служба установит, что реорганизация была фиктивной, она может доначислить налоги на сэкономленные средства.

Кроме того, компании могут пытаться уклониться от уплаты НДФЛ и страховых взносов в отношении постоянных сотрудников, заключая с ними договоры гражданско-правового характера (ГПХ) и переводя их в категорию самозанятых. Однако если сотрудники регулярно выполняют свои обязанности в соответствии с графиком организации и соблюдают должностные инструкции, то органы власти могут признать эти отношения трудовыми, доначислить необходимые суммы и назначить штраф.

Законным видом оптимизации налогообложения является налоговое планирование. Она включает в себя легальные способы, которые позволяют ИП и компаниям минимизировать налоговые обязательства.

Определение оптимальной налоговой системы

Выбор оптимального налогового режима на начальном этапе деятельности определяет эффективность финансового планирования компании. Российское законодательство предоставляет предпринимателям разнообразные варианты налогообложения, включая общую систему (ОСНО), упрощенную (УСН), автоматизированную упрощенную систему (АУСН), патентную (ПСН), единый сельскохозяйственный налог (ЕСХН), а также специальный режим для самозанятых граждан (НПД). Каждый налоговый режим имеет свои уникальные преимущества и ограничения [9]. Так, например, максимальный доход может колебаться в весьма широких пределах: от 2,4 млн рублей при использовании НПД до 450 млн рублей при применении УСН с 2025 года.

С 2025 года организации и ИП обязаны уплачивать НДС, если подпадают под его действие. В рамках АУСН, ПСН и НПД уплата НДС не предусмотрена. Другие системы налогообложения также позволяют работать без НДС при условии, что компания не реализует подакцизные товары, но с определенными ограничениями (табл. 1).

Таблица 1

Освобождение от уплаты НДС для различных систем налогообложения

|

Система налогообложения |

Условия освобождения от НДС |

Дополнительные требования |

|

УСН |

Доход за прошлый или текущий год не превышает 60 млн рублей |

- |

|

ЕСХН |

Доходы за предыдущий год не превышают 60 млн рублей |

Необходимо документально подтвердить и представить уведомление в налоговую (форма и формат утверждаются ФНС) |

|

ОСНО |

Выручка от реализации товаров (работ, услуг) за 3 месяца подряд не превышает 2 млн рублей |

Подать уведомление в ФНС |

Специальные налоговые режимы отличаются более низкими ставками по налогу на получаемый доход, а в некоторых случаях и полным отсутствием других налогов. Кроме того, отчетность может быть ограничена одной декларацией в год или вовсе не требоваться.

Законодательство предоставляет ИП более широкий выбор налоговых режимов по сравнению с ООО. Обществам с ограниченной ответственностью недоступны такие режимы, как НПД и ПСН. В то же время ИП могут совмещать два режима налогообложения.

При выборе УСН «доходы минус расходы» необходимо провести детальный анализ структуры расходов предприятия. В случае, если расходы превышают 70% от доходов, данная система налогообложения может оказаться более выгодной, чем режим УСН «доходы».

ОСНО представляет собой сложный, но потенциально выгодный налоговый режим для компаний, сотрудничающих с крупными контрагентами, применяющими ту же систему налогообложения. Компании, применяющие ОСНО и уплачивающие налог на добавленную стоимость (НДС), могут приобретать товары и услуги у контрагентов, также уплачивающих НДС. Это обусловлено тем, что такие контрагенты выставляют счета-фактуры с выделенным НДС, который компания может принять к вычету, тем самым уменьшая свой НДС к уплате. По этой причине крупные компании предпочитают сотрудничать с контрагентами, применяющими ОСНО, и избегают сотрудничества с компаниями, использующими другие налоговые режимы. Кроме того, применение ОСНО может быть особенно выгодно для организаций, деятельность которых подпадает под льготы по налогу на прибыль [10].

Оптимизация налоговой базы

Амортизационная политика. Ускоренное списание амортизационных отчислений позволяет оптимизировать налоговую базу организации за счет своевременного обновления основных производственных фондов. Это способствует минимизации налогооблагаемой прибыли предприятия в соответствии с законодательством.

Учет расходов. Тщательный учет операционных расходов и документальное подтверждение затрат организации позволяют законно уменьшить налогооблагаемую базу при соблюдении установленных нормативов.

Перенос убытков на будущие периоды. Механизм переноса убытков в рамках налогового планирования позволяет организациям компенсировать отрицательные финансовые результаты текущего отчетного периода путем последовательного снижения налогооблагаемой базы в последующих налоговых периодах [10].

Использование налоговых льгот и преференций

В соответствии с законодательством Российской Федерации, отдельные субъекты хозяйственной деятельности могут рассчитывать на налоговые льготы и преференции.

Статус малого бизнеса позволяет вести упрощенный учет, сдавать меньше документов в рамках регулируемой отчетности, платить более низкие налоги и не устанавливать лимит кассы.

Резиденты особых экономических зон, а также компании, работающие в сфере информационных технологий, получают значительные налоговые льготы. Для организаций, осуществляющих деятельность в сфере информационных технологий, предусмотрены значительные льготы в виде снижения страховых взносов и налога на прибыль. В 2025 году перечень видов деятельности, подпадающих под льготное налогообложение в IT-сфере, был расширен.

Также одним из видов налоговых льгот являются налоговые каникулы. Налоговые каникулы представляют собой временное освобождение от уплаты налогов для предпринимателей, которое действует до конца 2026 года. Эта мера поддержки распространяется на ИП, использующих УСН или ПСН. Преференции предоставляются предпринимателям, которые ведут деятельность в производственной, научной, социальной, туристической и гостиничной сферах, а также оказывающим бытовые услуги населению. Государственные налоговые льготы доступны предпринимателям, которые впервые регистрируют бизнес или возобновляют деятельность после региональных налоговых каникул. Также доход от льготных видов деятельности должен составлять не менее 70% от общего дохода. Освобождение от налогообложения распространяется исключительно на налог на доходы. Страховые взносы и прочие налоги, если таковые имеются, подлежат уплате и в период каникул [11].

Для информирования представителей малого и среднего бизнеса о государственных программах поддержки была создана специальная цифровая платформа. Это онлайн-сервис, который объединяет информацию из государственных баз данных и предоставляет предпринимателям доступ к полезным инструментам [12].

Законодательство строго регулирует использование организациями методов налоговой оптимизации. Использование незаконных методов минимизации налоговых обязательств влечет за собой уголовную ответственность в соответствии с действующим законодательством. Рациональное управление налоговыми обязательствами является инструментом стратегического планирования, обеспечивающим устойчивое развитие предприятия в долгосрочной перспективе, а не только краткосрочную экономию на налоговых отчислениях. Минимизация налоговых обязательств компании должна осуществляться с учетом поддержания высокого качества продукции и сохранения деловой репутации организации на рынке. В связи с этим, на основании проведенного исследования, мною предложены рекомендации, направленные на улучшение финансовых показателей и повышение конкурентоспособности бизнеса в условиях современного экономического регулирования:

- рекомендуется регулярное проведение внутренних проверок налоговой и финансовой отчетности организации. Аудит позволит своевременно выявлять ошибки в расчетах и предотвращать необоснованные налоговые выплаты. Проведение независимой экспертизы финансовой отчетности квалифицированными специалистами предоставляет компании возможности для оптимизации налогообложения в соответствии с действующим законодательством. Привлечение квалифицированного специалиста в области налогообложения позволит разработать индивидуальные методы оптимизации налоговой нагрузки с учетом специфики деятельности организации;

- применение технологических инноваций. Внедрение блокчейн-технологий в финансовую отчетность открывает новые возможности для обеспечения безопасности документооборота. Технология блокчейн существенно облегчает взаимодействие организаций с налоговыми органами при одновременном снижении вероятности возникновения неточностей в процессе ведения бухгалтерской документации;

- рекомендуется регулярное повышение квалификации сотрудников. Масштабные программы обучения налоговому планированию реализуются посредством современных дистанционных платформ, обеспечивающих доступность знаний для специалистов. Углубленное освоение методологии налоговой оптимизации существенно расширяет профессиональные возможности работников, способствуя росту финансовой результативности организации.

Таким образом, многоуровневое налоговое планирование позволяет предприятиям формировать надежную основу экономической устойчивости, минимизировать риски налоговых затрат и создавать оптимальные условия развития коммерческой деятельности.

Заключение

На основе проведенного анализа данных и литературного обзора существующих исследований можно сделать вывод, что представители малого и среднего предпринимательства вносят весомый вклад в развитие национальной экономики, одновременно преодолевая серьезные препятствия в виде повышенного налогового бремени и острой рыночной конкуренции. Проведенное исследование доказывает существенное влияние грамотной налоговой оптимизации на финансовую устойчивость небольших компаний. Рациональный подход к налоговому планированию обеспечивает предприятиям возможность сокращать фискальную нагрузку при сохранении высокой рыночной конкурентоспособности.

Законодательство Российской Федерации предусматривает разнообразные подходы к оптимизации налоговых обязательств компаний. Малым предприятиям следует регулярно анализировать актуальные изменения нормативно-правовой базы, совершенствовать систему внутреннего контроля и обеспечивать непрерывное развитие профессиональных компетенций персонала для эффективного применения легальных методов налогового планирования.

Таким образом, рациональное налоговое планирование становится ключевым фактором в динамичном развитии малого бизнеса, обеспечивая эффективную оптимизацию финансовых потоков через законные механизмы снижения налогового бремени. Грамотный подход к управлению налоговыми обязательствами способствует укреплению рыночных позиций предприятия, формируя надежную основу для стабильного экономического роста в существующих условиях государственного регулирования.

1. Krokhmal D.D. Development of tax tools to support entrepreneurial initiative // Taxes and taxation. 2022. No. 5. pp.16-24.

2. Analytical portal of the Federal Tax Service of Russia [Electronic resource] URL: https://analytic.nalog.gov.ru / (date of access: 04/02/2025)

3. Bykova N.N., Kiryushkina A.N., Kurilov K. Yu. Selected aspects of international tax planning and territorial taxation // Karelian Scientific Journal. 2019. Vol. 8, No. 2 (27). pp. 103-109.

4. Kalinskaya M. V., Ogarkova A. A., Nabok D. I. Modern financial instruments and technologies of tax planning and optimization // Bulletin of the Academy of Knowledge. 2021. No. 46(5). pp. 160-165. DOIhttps://doi.org/10.24412/2304-6139-2021-5-160-165. EDN OALFBN.

5. Ilyasov D. M. Tax optimization and its tools // Economic and humanitarian sciences. 2023. No. 10(381). pp. 12-19. DOIhttps://doi.org/10.33979/2073-7424-2023-381-10-12-19. EDN UFGQRM.

6. Polinskaya M. V., Chepelenko A. O., Lebedev S. R., Chernusskaya A. I. Business fragmentation: legitimate optimization or a tax crime? // Bulletin of the Academy of Knowledge. 2024. No. 4(63). pp. 482-487. EDN AFLCBY.

7. Vlasova S. V., Sahakyan A. G. On the issue of optimizing the legal mechanism for detecting tax crimes // Agrarian and land law. 2024. No. 4(232). pp. 300-302. DOIhttps://doi.org/10.47643/1815-1329_2024_4_300. EDN KMLXUI.

8. "The Tax Code of the Russian Federation (Part one)" dated 07/31/1998 N 146-FZ (as amended on 30.09.2024) [Electronic resource] URL: https://www.consultant.ru/document/cons_doc_LAW_19671/1bab8cfd8c4da82e8af44f7ebcbfa1716bac9586 / (date of access: 04/02/2025)

9. Tax optimization: types, methods and risks [Electronic resource] URL: https://www.ubrr.ru/dlya-biznesa/podderzhka-biznesa/spravochnik-predprinimatelya/nalogovaya-optimizaciya#_etzd1jl6ek4i (date of access: 04/02/2025)

10. BASIC general taxation system in 2025 [Electronic resource] URL: https://www.moedelo.org/club/article-knowledge/nalogooblozhenie-osno (date of access: 04/02/2025)

11. Tax holidays for Individual Entrepreneurs in the subjects of the Russian Federation [Electronic resource] URL: https://www.consultant.ru/document/cons_doc_LAW_190568 / (date of access: 04/02/2025)

12. Digital SME platform.RF [Electronic resource] URL: https://xn--l1agf.xn--p1ai/#services (date of access: 04/02/2025)