from 01.01.1993 to 01.01.2019

Siberian Federal University (Chair of Digital Financial Technologies of Sberbank of Russia, Associate professor)

from 01.01.2007 until now

Krasnoyarsk, Krasnoyarsk, Russian Federation

VAK Russia 5.2.3

VAK Russia 5.2.4

VAK Russia 5.2.5

VAK Russia 5.2.6

VAK Russia 5.2.7

UDC 338.27

UDC 336.2

The methods of forecasting used today in practice do not allow taking into account the influence of many external factors affecting the amount of tax revenue to the budget. This reduces the accuracy of forecasts. The article develops and tests a combined approach to forecasting tax revenue for the budget of a constituent entity of the Russian Federation. The approach integrates econometric methods for time series analysis and an expert assessment procedure. This minimizes systematic errors inherent in quantitative or qualitative methods.

budget revenues, regional budget, revenue forecasting, revenue modeling, tax revenues

Введение. Налоговое прогнозирование позволяет органам власти оценивать эффективность функционирования бюджетной системы, обосновывать будущие изменения законодательства в сфере налогообложения, своевременно реагировать на негативные изменения в экономике, а также сокращать расходы государственного бюджета, когда возможности обеспечения сбалансированности бюджета через доходные источники отсутствуют.

Основными источниками информации при составлении прогноза налоговых поступлений выступают: прогноз социально-экономического развития (СЭР), информация ФНС России, информация Росстата, законодательство, информация крупнейших налогоплательщиков, отраслевые и региональные данные. На практике прогнозирование налоговых поступлений чаще всего осуществляется при помощи статистических методов и методов экономического анализа.

Одной из важных проблем исследователи считают низкое качество прогнозов СЭР. В частности, зависимость от исторических данных, которые не всегда отражают текущие экономические тенденции. В условиях нестабильности рынка, санкций, пандемий или технологических сдвигов традиционные модели часто дают значительные погрешности. Кроме того, отсутствие оперативной статистики и неполнота информации затрудняют корректное прогнозирование.

Серьёзной проблемой остается теневая экономика и уклонение от уплаты налогов, а также высокие затраты, которые являются достаточно существенными. Периодические изменение налогового законодательства также требует постоянных корректировок прогноза. Необходимо анализировать большие объемы информации, прибегать к консультациям экспертов и учитывать влияние изменений на величину налоговой базы. Более того, значительные изменения налогового законодательства могут привести к снижению налоговых поступлений, поскольку такая нестабильность способствует увеличению объемов теневого сектора экономики.

Прогнозирование налоговых поступлений на практике чаще всего осуществляется при помощи статистических методов и методов экономического анализа. В частности, Стагниева С. И считает, что прогнозирование доходной части бюджета базируется на общеэкономических методах: анализ, ранжирование, корреляция, экспертные оценки и т.д. [9]. При этом выбор определенного метода зависит от целей и сроков прогнозирования.

Наиболее распространенным методом является экстраполяция, которая базируется на предположении о продолжении развития устойчивых тенденций, которые сложились в прошлые периоды. В основе его используется информация одномерных рядов динамики налоговых поступлений в бюджет за предшествующие периоды. Главным преимуществом данного метода является простота и наглядность расчетов, однако важным условием является приведение показателей различных периодов к сопоставимому виду. На практике чаще всего применяются: линейная экстраполяция, экспоненциальное сглаживание и адаптивные модели прогнозирования [2].

Для повышения эффективности экстраполяционного метода рекомендуется: применять данный метод преимущественно для краткосрочного прогнозирования (до 1 года); комбинировать его с другими методами (экспертными оценками, эконометрическим моделированием); регулярно актуализировать исходные данные; вводить корректирующие коэффициенты для учета изменений в налоговом законодательстве; применять методы сглаживания для уменьшения влияния случайных колебаний.

Метод экспертных оценок предполагает выдвижение предположений специалиста касаемо будущей динамики определённой доходной статьи бюджета на основе своего опыта налогового планирования, высокого уровня владения действующим налоговым законодательством, исследования динамики налоговых поступлений, уровня собираемости и задолженности, а также прочих статистических показателей [3]. В данном случае происходит сравнение имеющихся статистических данных с оценками экспертов из различных областей экономики. Этот метод применяется в условиях нестабильности или отсутствия достаточной статистики.

Условно-статистический метод представляет собой построение модели, учитывающую в себе расчет прямых эффектов, которые могут возникать из-за изменения налогового законодательства и методов налогового администрирования, и влиять на величину налоговой базы.

Условно-динамический метод предполагает построение модели временных рядов и основывается на показателе эластичности налоговых поступлений. Он позволяет оценить влияние косвенных факторов на изменение величины налоговой базы [7].

Также при прогнозировании налоговых поступлений в бюджетную систему эксперты используют эконометрические методы, основанные на построении регрессионных моделей, в которых выражается взаимосвязь зависимой переменной и ряда значимых факторов. В качестве информационной базы могут выступать временные ряды налоговых поступлений и социально-экономические показатели территории [4].

Проблемы прогнозирования налоговых доходов

В процессе прогнозирования налоговых поступлений многие финансисты и исследователи сталкиваются с рядом трудностей, которые негативно сказываются на качестве расчетных прогнозов. Одной из важных проблем ученые выделяют низкое качество прогнозов СЭР. Так, Н.И. Сидорова [8] отмечает, что составление проектов бюджетов основывается на прогнозе СЭР, который не обеспечивает надежности и достоверности. Отклонение фактических показателей от тех, которые были заложены в первоначальном прогнозе, оказывает большое влияние на качество прогнозирования доходных источников.

Одной из основных проблем является зависимость от исторических данных, которые не всегда отражают текущие экономические тенденции. В условиях нестабильности рынка, санкций, пандемий или технологических сдвигов традиционные модели часто дают значительные погрешности. Кроме того, отсутствие оперативной статистики и неполнота информации затрудняют корректное прогнозирование.

Следующей немаловажной проблемой прогнозирования является теневая экономика и уклонение от уплаты налогов. В частности, О. В. Мусина, А. П. Еприкян [6] отмечают недостаток информации о величине теневого сектора экономики может приводить к ошибкам при принятии решений в области политики, экономики, в том числе при прогнозировании доходной части бюджета.

Отдельные ученые в качестве проблемы прогнозирования также выделяют отсутствие единой и качественной методической базы для формирования прогнозов [5]. В данном случае речь идет о применении неэффективных и устаревших методов прогнозирования, малая степень использования методов математического моделирования процессов, не учитывание множества макроэкономических факторов. Многие методы налогового прогнозирования не учитывают влияние внешнеэкономических и политических факторов, таких как изменения в международном законодательстве, колебания курсов валют или глобальные кризисы. Это приводит к завышенным или заниженным оценкам поступлений, что негативно сказывается на бюджетном планировании. Несмотря на развитие искусственного интеллекта и big data, многие финансовые органы продолжают использовать устаревшие методы прогнозирования. Машинное обучение и нейросети могли бы повысить точность за счет анализа больших массивов данных, но их применение остается ограниченным из-за бюрократических барьеров и недостатка финансирования.

Кроме того, классические экономико-математические модели, такие как регрессионный анализ или методы временных рядов, обладают низкой гибкостью. Они плохо адаптируются к резким изменениям в налоговой политике или структуре экономики. В результате прогнозы становятся менее точными, особенно в долгосрочной перспективе. Даже при использовании сложных алгоритмов окончательные прогнозы часто корректируются экспертами, что вносит субъективность. Лоббирование интересов отдельных ведомств или политические мотивы могут искажать реальные данные, снижая объективность расчетов.

Также важной проблемой при процессе налогового прогнозирования выступают высокие затраты, которые являются достаточно существенными [10]. Одной из главных причин является регулярное изменение налогового законодательства. В связи с этим требуется анализировать большие объемы информации, прибегать к консультациям экспертов и учитывать влияние изменений на величину налоговой базы. Более того, значительные изменения налогового законодательства могут привести к снижению налоговых поступлений, поскольку нестабильность налогового законодательства способствует увеличению объемов теневого сектора экономики [1].

Все перечисленные проблемы препятствуют построению качественного прогноза налоговых поступлений в бюджет, соответственно, для повышения точности прогнозирования экспертам необходимо брать во внимание эти факторы. Совершенствование методов налогового прогнозирования требует комплексного подхода: интеграции современных технологий, повышения качества данных и минимизации субъективного влияния. Только так можно добиться более точных и надежных прогнозов, способствующих стабильному бюджетному планированию.

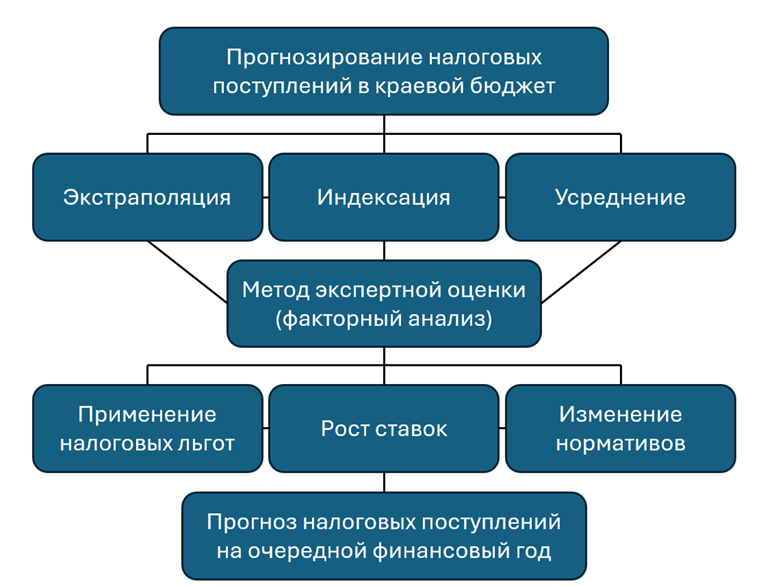

В данном исследовании представляем методический подход, позволяющий частично нивелировать перечисленные выше недостатки. Он был апробирован на данных бюджета Красноярского края. Прогнозирование доходных источников краевого бюджета в настоящее время осуществляется по следующей схеме (рис 1.) На первом этапе к факту текущего года применяется индексация (чаще всего ИПЦ или прогнозируемый уровень инфляции из прогноза СЭР), экстраполяция или усреднение, если используются данные о фактическом поступлении за несколько периодов. На втором этапе полученный показатель корректируется экспертной оценкой, где специалисты при помощи факторного анализа учитывают влияние изменения законодательства, в частности: применение налоговых льгот, рост налоговых ставок, изменение нормативов зачисления средств в бюджеты бюджетной системы и др.

Рис. 1. Схема прогноза налоговых поступлений в региональный бюджет

Мы предлагаем дополнить схему прогнозирования налоговых поступлений в краевой бюджет, используя моделирование временных рядов (рис. 2). На первом этапе производится сбор и обработка временных рядов основных социально-экономических показателей, а также фактических налоговых поступлений в региональный бюджет. Затем проводятся формальные тесты и исследуемые временные ряды приводятся к виду, пригодному для дальнейшего построения VAR-модели. После построения регрессионной модели из нее исключаются незначимые переменные. И финальной стадией первого этапа является построение первоначального прогноза по VAR-модели. На втором этапе применяется метод экспертной оценки, в ходе которого эксперт на основании сроков уплаты налогов, динамики поступлений налоговых доходов прошлых периодов и иной информации выбирает одно из трех значений (верхняя или нижняя граница 95 % доверительного интервала или среднее значение) прогноза, полученного на первом этапе.

Рис. 2. Схема построения прогноза налоговых поступлений в региональный бюджет с применением моделирования

В процессе исследования мы провели прогноз налоговых доходов регионального бюджета, согласно предложенной схеме в разрезе каждого доходного источника и сопоставили полученный прогноз с оценками минфина Красноярского края, учтенных в бюджете 2025 года.

Данные и методы

Для расчетов мы использовали семь основных налоговых источников доходов краевого бюджета, а также 12 показателей, которые могут оказывать влияние на величину доходов по уплате конкретного налогового источника (Таблица 1). Для построения прогноза налоговых поступлений использованы официальные данные Росстата и министерства финансов Красноярского края. Выборка представляет собой временной ряд ежемесячных данных в период с 2013 по 2024 годы, 144 наблюдения по каждой переменной. В качестве инструментария был выбран эконометрический метод построения моделей векторной авторегрессии (далее – VAR).

Таблица 1

Обзор переменных

|

Обозначение переменной |

Описание переменной |

Единицы измерения |

|

Income tax |

Налог на прибыль организаций |

тыс. руб. |

|

Personal income tax |

НДФЛ |

тыс. руб. |

|

Excise tax |

Акцизы |

тыс. руб. |

|

NDPI |

Налог на добычу полезных ископаемых |

тыс. руб. |

|

Transport tax |

Транспортный налог |

тыс. руб. |

|

USN |

УСН |

тыс. руб. |

|

NIO |

Налог на имущество организаций |

тыс. руб. |

|

Inflation |

Уровень инфляции |

% |

|

Labor force |

Численность рабочей силы |

шт. |

|

Dollar |

Курс доллара |

руб. |

|

CENTRAL Bank |

Уровень ключевой ставки ЦБ |

% |

|

Unemployment |

Уровень безработицы |

% |

|

Migration |

Миграционный (приток/отток) |

чел. |

|

Salary |

Средняя начисленная заработная плата |

руб. |

|

Retail |

Оборот розничной торговли |

тыс. руб. |

|

Wholesale trade |

Оборот оптовой торговли |

тыс. руб. |

|

Legal entity |

Число зарегистрированных юридических лиц |

шт. |

|

IP |

Число зарегистрированных ИП |

шт. |

Зависимой переменной является величина налоговых поступлений в бюджет Красноярского края (каждый доходный источник по-отдельности). Построенная динамика временных рядов исследуемых переменных указывает на наличие явного тренда и сезонности, что может свидетельствовать о нестационарности рассматриваемых временных рядов, поэтому при помощи формального теста Дикки-Фуллера, мы убедились, что все исследуемые ряды являются нестационарными, о чем свидетельствовали высокие p-значения (таблица 2).

Таблица 2

Результаты расширенного теста Дикки-Фуллера

|

Название переменной |

Исходный временной ряд |

После взятия первой разности |

|||||

|

Константа |

Константа и тренд |

Константа |

Константа и тренд |

||||

|

Income tax |

0,7431 |

9,52*10^-8 |

0,0001 |

0,0011 |

|||

|

Personal income tax |

0,9998 |

1,0000 |

3,12*10^-10 |

6,46*10^-10 |

|||

|

Excise tax |

0,9972 |

0,6586 |

5,07*10^-8 |

2,18*10^-8 |

|||

|

NDPI |

1,0000 |

0,9955 |

1,81*10^-9 |

3,08*10^-9 |

|||

|

Transport tax |

0,9927 |

0,3025 |

2,91*10^-7 |

1,54*10^-6 |

|||

|

USN |

0,9473 |

0,4494 |

0,0113 |

0,0304 |

|||

|

NIO |

0,9208 |

0,1749 |

1,12*10^-12 |

1,66*10^-13 |

|||

|

Inflation |

0,2623 |

0,5774 |

0,0033 |

0,0193 |

|||

|

Labor force |

0,4894 |

0,9720 |

0,0561 |

0,0230 |

|||

|

Dollar |

0,7384 |

0,2008 |

8,28*10^-15 |

1,02*10^-13 |

|||

|

CENTRAL Bank |

0,4028 |

0,5590 |

2,67*10^-12 |

9,49*10^-12 |

|||

|

Unemployment |

0,8591 |

0,4034 |

2,91*10^-9 |

1,85*10^-8 |

|||

|

Migration |

0,2784 |

0,5077 |

7,66*10^-10 |

7,15*10^-9 |

|||

|

Salary |

1,0000 |

1,0000 |

0,0086 |

0,0359 |

|||

|

Retail |

1,0000 |

0,9997 |

0,0826 |

0,0246 |

|||

|

Wholesale trade |

0,9995 |

0,9381 |

0,0201 |

0,0213 |

|||

|

Legal entity |

0,7266 |

0,3820 |

5,03*10^-8 |

1,15*10^-7 |

|||

|

IP |

0,2005 |

0,4578 |

3,49*10^-6 |

1,28*10^-5 |

|||

После приведения временных рядов к стационарности были проведены формальные тесты, для определения оптимального количества лагов при построении модели. В качестве информационных критериев выступали: критерий Акаике (AIC), критерий Шварца (BIC) и критерий Хеннана – Куинна (HQC), значения которых должны быть минимальными. В результате оценок моделей с различным количеством лагов, на основании значений критериев было выбрано оптимальное количество лагов для модели VAR равное 4.

При построении модели VAR по умолчанию использовались робастные стандартные ошибки, которые устойчивы к гетероскедастичности и автокорреляции. Также был проведен тест на мультиколлинеарность факторных переменных. Переменные, у которых значения VIF-теста превышали 3 были поочередно исключены из модели (с наибольшим значением VIF-теста) для устранения из модели мультиколлинеарности переменных. Модель VAR налога на прибыль после устранения мультиколлинеарности представлена в таблице 3.

Таблица 3

Модель VAR налог на прибыль

|

VAR система, порядок лага 4 |

||||||||||||||||||||||||||||||

|

Метод оценки - МНК, наблюдения 2013:01-2024:12 (T = 144) |

||||||||||||||||||||||||||||||

|

Лог. правдоподобие = -8808,3022 |

||||||||||||||||||||||||||||||

|

Определитель ковариационной матрицы = 8,9005044e+043 |

||||||||||||||||||||||||||||||

|

Крит. Акаике = 131,5295 |

||||||||||||||||||||||||||||||

|

Крит. Шварца = 138,5596 |

||||||||||||||||||||||||||||||

|

Крит. Хеннана-Куинна = 134,3864 |

||||||||||||||||||||||||||||||

|

Портмане-тест (Portmanteau): LB(34) = 2764,73, Ст. свободы = 2430 [0,0000] |

||||||||||||||||||||||||||||||

|

Уравнение 1: incometax |

||||||||||||||||||||||||||||||

|

Робастные оценки стандартных ошибок (с поправкой на гетероскедастичность), вариант HC1 |

||||||||||||||||||||||||||||||

|

|

Коэффициент |

Ст. ошибка |

t-статистика |

P-значение |

|

|||||||||||||||||||||||||

|

const |

2,89373e+06 |

773917 |

3,7391 |

0,0003 |

*** |

|||||||||||||||||||||||||

|

incometax_1 |

0,207929 |

0,086759 |

2,3966 |

0,0184 |

** |

|||||||||||||||||||||||||

|

incometax_2 |

0,21142 |

0,0868213 |

2,4351 |

0,0166 |

** |

|||||||||||||||||||||||||

|

incometax_4 |

0,223264 |

0,074778 |

2,9857 |

0,0035 |

*** |

|||||||||||||||||||||||||

|

d_dollar_2 |

332664 |

147981 |

2,2480 |

0,0267 |

** |

|||||||||||||||||||||||||

|

d_inflation_4 |

1,03583e+06 |

471696 |

2,1960 |

0,0304 |

** |

|||||||||||||||||||||||||

|

d_unemployment_1 |

−7,3269e+06 |

3,39136e+06 |

−2,1605 |

0,0331 |

** |

|||||||||||||||||||||||||

|

d_migration_1 |

1932,03 |

799,097 |

2,4178 |

0,0174 |

** |

|||||||||||||||||||||||||

|

d_salary_1 |

311,274 |

151,436 |

−2,0555 |

0,0424 |

** |

|||||||||||||||||||||||||

|

d_retail_3 |

−1047,29 |

370,185 |

−2,8291 |

0,0056 |

*** |

|||||||||||||||||||||||||

|

d_Wholesaletrade_2 |

−510,476 |

115,344 |

−4,4257 |

<0,0001 |

*** |

|||||||||||||||||||||||||

|

d_Wholesaletrade_3 |

239,542 |

94,3056 |

2,5401 |

0,0126 |

** |

|||||||||||||||||||||||||

|

d_legalentity_3 |

4960,42 |

2387,36 |

−2,0778 |

0,0402 |

** |

|||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||

По результатам построения VAR модели значимыми факторами для зависимой переменной – налог на прибыль организаций оказались прошлые значения временного ряда зависимой переменной, а также изменения: курса доллара; уровня инфляции; уровня безработицы; миграционного движения населения; уровня заработай платы; объема розничной и оптовой торговли, численности зарегистрированных юридических лиц. Качество модели достаточно неплохое, о чем свидетельствует значение коэффициента детерминации (

Аналогичным образом были построены VAR модели по другим бюджетообразующим налогам: НДФЛ, налог на имущество организаций, налог на добычу полезных ископаемых, акцизы, транспортный налог и УСН.

Результаты, моделирования прогноза налоговых поступлений в региональной бюджет на 2025 год показали, что полученные модели VAR второго порядка имеют достаточно высокую объясняющую способность (об этом свидетельствует значение R-квадрат, варьирующийся в диапазоне от 0,58 до 0,77). Построенные прогнозы на основании уравнений VAR показали, что само качество прогнозирования невысоко: доверительные интервалы оказываются шире, чем вся амплитуда колебаний ряда в течение периода прошлых наблюдений. Увеличение количества наблюдений в несколько раз, а также включение в неё дополнительных значимых факторов может существенно сократить ширину доверительного интервала и повысить прогностическую способность модели.

Затем мы сопоставили прогнозные значения модели VAR по всем дозорным источникам с оценкой минфина края, учтенной в бюджете 2025 года (табл. 4).

Таблица 4

Сопоставление прогноза VAR и прогноза минфина края

|

Учтено в бюджете, тыс. рублей |

Прогноз VAR |

Отклонение прогноз VAR от Учтено в бюджете, тыс. рублей |

Отклонение Прогноз VAR от Учтено в бюджете, % |

|

Налог на прибыль организаций |

|||

|

147 196 244,9 |

114 752 424,1 |

-32 443 820,8 |

-22,0 % |

|

НДПИ |

|||

|

34 308 418,6 |

27 896 896,7 |

-6 411 521,9 |

-18,7 % |

|

НДФЛ |

|||

|

121 105 671,4 |

115 367 013,7 |

-5 738 657,7 |

-4,74 % |

|

НИО |

|||

|

29 276 773,7 |

19 791 112,8 |

-9 485 660,9 |

-32,4 % |

|

Акцизы |

|||

|

19 259 349,8 |

22 713 224,8 |

3 453 875,0 |

+17,9 % |

|

Транспортный налог |

|||

|

3 663 904,9 |

2 331 747,7 |

-1 332 157,2 |

-36,4 % |

|

УСН |

|||

|

11 856 359,6 |

6 193 092,9 |

-5 663 266,8 |

-47,8 % |

Прогноз модели VAR значительно отличается от оценки минфина края (отклонения составляют более 10 %). Таким образом данный прогноз модели VAR не рекомендуется использовать. Однако, для получения реалистичного прогноза, сопоставимого с оценкой минфина края, необходимо применить метод экспертной оценки к получившимся прогнозам VAR. Суть метода экспертной оценки: взяв за основу параметры прогноза модели VAR (среднее значение, нижняя и верхняя границы 95 % доверительного интервала), эксперт на основании сроков уплаты платежей, а также структуры и динамики прошлых периодов, выбирает одно из трех значений в каждом месяце (табл. 5).

Таблица 5

Прогноз НИО с применением метода экспертной оценки, тыс. руб.

|

Месяц |

Нижняя граница 95% доверительного интервала |

Среднее значение |

Верхняя граница 95% доверительного интервала |

Итоговый прогноз методом экспертной оценки |

Учтено в бюджете |

|

Январь 2025 |

-1 088 014,7 |

1 618 084,0 |

4 324 182,6 |

1 618 084,0 |

20 006,6 |

|

Февраль 2025 |

-3 220 272,5 |

-84 501,1 |

3 051 270,2 |

3 051 270,2 |

3 385 047,5 |

|

Март 2025 |

-2 628 489,5 |

792 867,8 |

4 214 225,1 |

4 214 225,1 |

3 589 508,1 |

|

Апрель 2025 |

2 829 153,0 |

6 338 467,1 |

9 847 781,1 |

6 338 467,1 |

6 492 621,1 |

|

Май 2025 |

-2 518 054,3 |

1 194 042,7 |

4 906 139,7 |

1 194 042,7 |

591 793,0 |

|

Июнь 2025 |

-3 995 934,9 |

-251 598,3 |

3 492 738,2 |

-251 598,3 |

156 698,6 |

|

Июль 2025 |

-428 148,4 |

3 401 105,8 |

7 230 360,0 |

7 230 360,0 |

7 241 578,9 |

|

Август 2025 |

-3 379 883,6 |

496 534,1 |

4 372 951,8 |

496 534,1 |

78 514,1 |

|

Сентябрь 2025 |

-3 775 227,4 |

112 602,8 |

4 000 432,9 |

112 602,8 |

8 394,4 |

|

Октябрь 2025 |

-1 286 575,3 |

6 575 492,6 |

6 575 492,6 |

6 575 492,6 |

7 562 624,4 |

|

Ноябрь 2025 |

-3 124 282,5 |

819 176,2 |

4 762 635,0 |

819 176,2 |

122 122,7 |

|

Декабрь 2025 |

-3 441 696,9 |

509 873,1 |

4 461 443,1 |

509 873,1 |

27 864,3 |

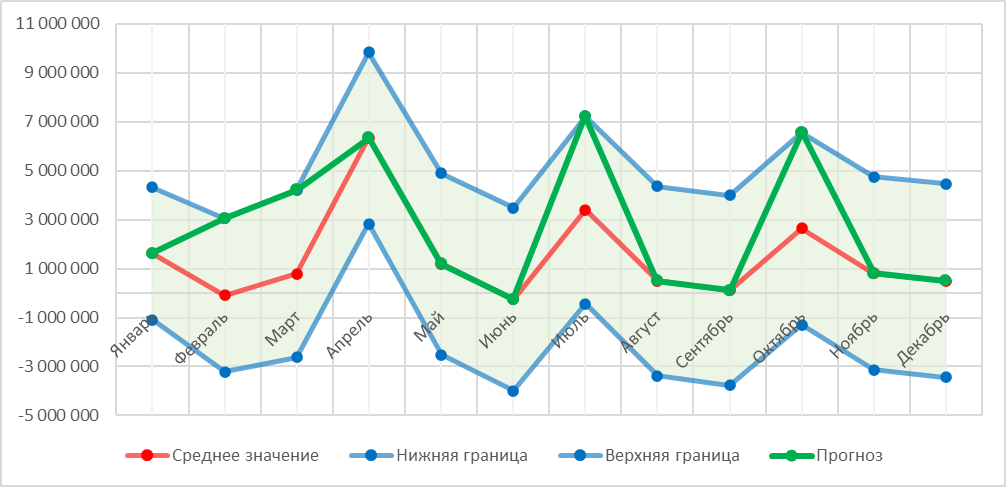

В феврале и марте в бюджет региона поступают крупные платежи по НИО – это доплата по итогам предыдущего года (2024 года). По этой причине в итоговом прогнозе в эти месяцы были выбраны верхние границы 95 % доверительного интервала. В июле в бюджет края также поступит существенный платеж за второй квартал 2025 года, а в октябре поступит крупный платеж за третий квартал текущего года – по этой же причине в этих месяцах в итоговом прогнозе учтена верхняя граница 95 % доверительного интервала первоначального прогноза VAR модели (рис. 3).

Полученные модели имеют достаточно высокий уровень объясняющей способности, о чем свидетельствуют высокие значения коэффициента детерминации.

Рис. 3. Итоговый прогноз поступлений НИО в краевой бюджет

Однако использование исключительно средних значения прогноза модели VAR не позволяет использовать полученные оценки на практике (не сопоставимо с параметрами, учтенными при формировании бюджета). Для решения этой проблемы было предложено в процесс построения прогноза добавить второй этап – метод экспертной оценки первоначального прогноза модели VAR. На втором этапе эксперт делает выбор в пользу одного из трех значений первоначального прогноза ежемесячно на основании своего опыта и имеющейся у него информации. Итоговые прогнозы налоговых поступлений по каждому налоговому источнику показали соизмеримые результаты, как с оценкой министерства финансов Красноярского края, так и с фактическим поступлением за 5 месяцев 2025 года. Таким образом, прогноз построенный в два этапа с использованием эконометрических методов моделирования и экспертной оценки позволяет получить достаточно качественный прогноз, пригодный для дальнейшего использования в работе.

Представленный методический подход может использоваться финансовыми органами как дополнительный фактор принятия решения при прогнозировании налоговых поступлений в бюджет региона. Кроме того, включение в модель дополнительных данных за больший временной период, а также использование более сложного эконометрического инструментария позволит повысить точность прогнозов.

1. Akimov, N. N. Prognozirovanie nalogovyh postupleniy v sub'ekte Rossiyskoy Federacii / N. N. Akimov, V. N. Edronova, // Finansy i kredit. – 2008. – №17 (305). – S. 51–54. EDN: https://elibrary.ru/IJVKOH

2. Boboshko N. M. Vyyavlenie tendenciy razvitiya nalogovyh postupleniy v konsolidirovannyy byudzhet sub'ektov RF // Vesnik ekonomicheskoy bezopasnosti. – 2021. – №2. – S. 298–304. DOI: https://doi.org/10.24412/2414-3995-2021-2-298-304; EDN: https://elibrary.ru/QIXYID

3. Valimuhametova E.R. Ekonometricheskoe modelirovanie nalogovyh postupleniy v byudzhet Rossii / E.R. Valimuhametova, I. B. Govako // Ekonomika i socium. – 2014. – №2 (11). – S. 872–874. EDN: https://elibrary.ru/SZXMXN

4. Grafova T. O. Prognozirovanie postupleniy federal'nyh nalogov i sborov pri pomoschi ekonometricheskogo modelirovaniya / T. O. Grafova, K. V. Kolesnikova // Inzhenernyy vestnik Dona. – 2020. – №7. – S.1–10. EDN: https://elibrary.ru/BKEAIZ

5. Lavrenchuk E. N Ocenka faktorov, vliyayuschih na nalogovye postupleniya v byudzhet regionov / E. N. Lavrenchuk, D. A. Kirpischikov // Vestnik Moskovskogo universiteta. – 2021. – №5 (6). – S. 136–154. DOI: https://doi.org/10.38050/01300105202157

6. Musina O. V. Analiz i prognozirovanie nalogovyh postupleniy v byudzhet, v ramkah primeneniya matematicheskih metodov v ekonomike / O. V. Musina, A. P. Eprikyan // Finansovaya ekonomika. – 2020. – №6. – S. 64–79. EDN: https://elibrary.ru/UXVUFU

7. Parhomenko, V. S. Ispol'zovanie modeley prognozirovaniya dlya opredeleniya ob'ema nalogovyh postupleniy v konsolidirovannyy byudzhet Krasnodarskogo kraya / V. S. Parhomenko, M. Yu. Ryabceva, A. A. Hramchenko, // Vestnik Akademii znaniy. – 2020. – №41 (6). – S. 357–362. DOI: https://doi.org/10.24412/2304-6139-2020-10817; EDN: https://elibrary.ru/PLTTIX

8. Sidorova, N. I. Problemy i instrumenty srednesrochnogo finansovogo planirovaniya na regional'nom i municipal'nom urovnyah // Problemy prognozirovaniya. – 2008. – №6. – S. 38–45. EDN: https://elibrary.ru/JWZTVN

9. Stagnieva, S. I. Issledovanie definiciy nalogovogo planirovaniya i prognozirovaniya // Gumanitarnye, social'no-ekonomicheskie i obschestvennye nauki. – 2014. – №6 (1). – S. 1–7.

10. Zakharova, K.A.; Muravyev, D.A.; Karagulian, E.A.; Baburina, N.A.; Degtyaryova, E.V. Assessment of Factors Affecting Tax Revenues: The Case of the Simplified Taxation System in the Russian Federation. J. Risk Financial Manag. 2024, 17, 562. https://doi.org/10.3390/jrfm17120562 EDN: https://elibrary.ru/BJXEDJ

11. Suglobov A.E., Cherkasova Yu.I., Petrenko V.A. Mezhbyudzhetnye otnosheniya v Rossiyskoy Federacii. -M.: Yuniti-Dana, 2013. -320 s. EDN: https://elibrary.ru/RTTGIZ

12. Suglobov A.E., Slobodchikov D.N. Nalogovyy potencial v sisteme byudzhetnogo regulirovaniya: etapy razvitiya i perspektivy // Nalogi i nalogooblozhenie. 2009. № 8. S. 4-15. EDN: https://elibrary.ru/TAMQST

13. Suglobov A.E., Cherkasova Yu.I. Analiz zarubezhnogo opyta byudzhetnogo vyravnivaniya // Nacional'nye interesy: prioritety i bezopasnost'. 2009. № 3. S. 68-75. EDN: https://elibrary.ru/JWAMXD

14. Orlova E.A., Lipalina S.Yu. Ocenka effektivnosti deyatel'nosti predpriyatiya s ispol'zovaniem sbalansirovannoy sistemy pokazateley // Vestnik Moskovskogo universiteta MVD Rossii. 2013. № 11. S. 221-227. EDN: https://elibrary.ru/RSSUUL