с 01.04.2014 по 07.11.2018

Пенза, Пензенская область, Россия

с 01.01.2008 по настоящее время

Пенза, Пензенская область, Россия

Саранский кооперативный институт (филиал) Российского университета кооперации (Кафедра "Менеджмент и торговое дело", доцент)

Саранск, Республика Мордовия, Россия

ВАК 08.00.05 Экономика и управление народным хозяйством (по отраслям и сферам деятельности, в том числе: экономика, организация и управление предприятиями, отраслями, комплексами; управление инновациями; региональная экономика; логистика; экономика труда; экономика народонаселения и демография; экономика природопользования; экономика предпринимательства; маркетинг; менеджмент; ценообразование; экономическая безопасность; стандартизация и управление качеством продукции; землеустройство; рекреация и туризм)

ВАК 08.00.10 Финансы, денежное обращение и кредит

ВАК 08.00.12 Бухгалтерский учет, статистика

ВАК 08.00.13 Математические и инструментальные методы экономики

ВАК 08.00.14 Мировая экономика

УДК 33 Экономика. Экономические науки

ГРНТИ 06.52 Экономическое развитие и рост. Прогнозир-ние и планирование экономики. Экономич. циклы и кризисы

ОКСО 38.03.01 Экономика

ОКСО 38.07.02 Экономическая бехопасность

ОКСО 38.05.01 Экономическая безопасность

ОКСО 38.04.01 Экономика

ББК 6505 Управление экономикой. Экономическая статистика. Учет. Экономический анализ

ББК 6523 Планирование. Экономическое прогнозирование

ББК 6532 Экономика агропромышленного комплекса. Экономика сельского хозяйства

BISAC BUS027020 Finance / Financial Risk Management

BISAC BUS063000 Strategic Planning

В статье показано, что благодаря мерам, принятым с целью создания благоприятных условий для инвестирования, совершенствования правовых, организационных и экономических механизмов развития инвестиционной деятельности в России, произошло увеличение притока капитала в аграрный сектор экономики как из бюджетных источников, так и из внебюджетных источников финансирования. Это привело к определенному экономическому развитию товаропроизводителей, но не привело к технологическому прорыву, который можно ожидать из-за интенсификации притока инвестиций в сельскохозяйственное производство. В условиях современности используемые механизмы и инструменты исчерпали все возможные способы привлечения ресурсов. Доказано, что методология оценки экономической добавленной стоимости, широко используемая в западных странах для финансового управления инвестициями, может стать действенным инструментом мобилизации дополнительных источников основного и оборотного капитала в аграрном бизнесе. Построена модель функциональной зависимости между доходностью и инвестиционным капиталом. На примере Пензенской области были сделаны расчеты, которые показывают, что вложения в аграрный бизнес имеют существенный потенциал роста эффективности за счет прироста добавленной стоимости.

инвестиции, экономическое развитие, экономика

- Introduction

Recently Russia has been making attempts to avoid the scenario of exporting only raw materials in development of national economy. Today, in the existing social and economic situation, external economic restrictions, time to reject the principle "oil in exchange for the food" has come. To make these postulates not simply a declaration, but let them receive a new round of development in exchange to old methods of management in agrarian business, in recent years the Government of the Russian Federation makes considerable efforts to attract additional financial resources and create favorable conditions of development for the agrarian sector of economy. For this purpose, in priority, the legislation of investment management has undergone some alterations.

General rates of capital investments (The federal law, 1999, No. 39-FZ) and investing activities (The federal law, 1999, No. 160-FZ) have been modernized, agro-industrial complex has received a legal status (The federal law, 2006, No. 264-FZ). Lately the Priority national project "Development of Agrarian and Industrial Complex" has been realized, the Federal law "Concerning Development of Rural Economy" has been adopted, the Doctrine of food security has been enacted, two state programs of development of agricultural industry and regulation of the markets of agricultural products, raw materials and the food for 2008-2012 and 2013-2020 have been carried out. They have become a basis of the current agrarian policy in Russia.

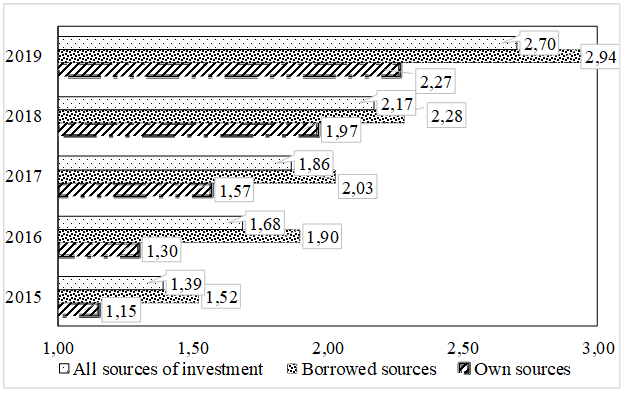

The improved legal base has allowed to expand and strengthen the state guarantees for producers of agricultural products. It has led to mobilization of budgetary appropriations into agricultural industry, increase of credit resources, attraction of private investments. As for Penza region the total amount of investments in 2019 has increased in comparison to 2014 by 2,7 times (fig. 1).

Source: Authors’ calculations based on the financial statements 220 agricultural enterprises of the Penza region

Figure 1. Growth rate of investments into agricultural industry of the Penza region in 2015-2019 by 2014, coefficient

Owned sources of financing of agricultural production have grown during 2015-2019 almost by 2,3 times, and borrowed funds – almost by 3 times.

However, it has still appeared not to be enough. The existing amount of financial resources and tools allow to stimulate the stagnant agricultural economy, having provided growth only at the level of 3% in recent years, but do not create an environment for the accelerated development of the industry, expanded reproduction of means and instruments of production, manpower resources. The considerable part of the farmland is still not in use. The budget restrictions cause the necessity of additional investment infusion, search for some new sources of financing and that is why it is important to involve the organizational and economic tools directed to increase of investment appeal of agrarian business (Samygin, Baryshnikov, Shlapakova, 2017).

- Problem Statement

At the present stage, along with the taken measures for increase in financial stability of landowners, since 2014 the Government of the Russian Federation tries to create conditions for accumulation of volumes of crediting of the organizations of the real sector of economy within the program of support of the investment projects realized in Russia on the basis of project financing. However, conditions of the program allow to count on state support and preferential crediting only to investment projects more than with the billion budget.

By our calculations, only for the last 3 years (2017-2019) against the background of growth long-term (+24%) and short-term (+37%) sources there was a decrease in the share capital (29%) that speaks about low investment attractiveness of the agrarian sector for private investors. They are frightened off by high risks of investment investments in agriculture. Many of them prefer to store money on bank deposits, in the state and corporate securities better, to use them in the financial markets.

All this demands not only increases in efficiency of the involved financing sources, but also researches of new reserves involvement of spare capital of other investors for what other organizational and economic tools of the mechanism of increase in investment attractiveness of agrarian business are necessary essentially.

- Research Questions

The primitive increase in market prices will lead to food catastrophe, and therefore cannot be considered as an alternative (Bespahotnyj, 2016). The banking sector is already involved into financing of agrarian production via guarantee state tools of subsidizing an interest rate (Seleznev, 2015). Another category of investors is scared away by high risks of investing into this sphere. Many of them prefer to deposit money in banks, buy government and corporate securities or use it in the financial markets, etc.

Abroad Central Banks and Governments of some countries have introduced a negative interest rate for the credits and deposits to activate consumer demand and to direct investors to real sector of production (Wang, 2016).

In the Russian regions, investments in agrarian economy are used to be attracted via investment areas of agrarian type, which allow the investor to understand the current state of the food market conjuncture.

The investment area is a free land parcel or a plot with buildings, constructions and engineering infrastructure, which is located on it and provide the implementation of investment projects (Goncharov, 2016).

From 2014 the program of support of investment projects implemented in Russia on the basis of project financing (Government, 2014) was added to this. It was developed in order to increase the amount of lending to the real sector of the economy on the long-term and concessionary terms. It can be noted as a positive thing, creating the financial preconditions for attracting investments. At the same time, there remain problems of organizational and economic nature.

Investment areas in different regions significantly differ from each other in natural-economic conditions, resulting in different production capabilities (Poshkus, 1979). Such information is not available for potential investors and this does not present the real situation of the competitive advantages of different investment areas for them. For this reason, it is not always clear what type of agricultural production will be financially and economically effective and what food will have a high demand on the regional market or beyond (Cordeiro, Kent, 2001).

Our analysis of agro-food policy according to OECD methods can present the agricultural benefits of the regions. But in some cases the demand for certain agricultural products is not always accompanied by efficiency in their production in the region (Gamba, Triantis, 2008). The same applies to the supply, the production of highly efficient types of products is not always popular in certain regions (Anastassiadis, Liebe, Mußhoff, 2015).

- Purpose of the Study

Research objective - to create the instruments of support of adoption of investment decisions in the agrarian sector including a method of the analysis of economic value added and model of assessment of efficiency of potential investments in agrarian business.

- Research Methods

One of the most optimal variants can be the substantiated recommendations about which projects are more appropriate for implementation on particular investment area both from the perspective of market efficiency, and social significance at certain budget guarantees of income for investors (Jahangir, Darron, Gizelle, 2016).

The initiators of the projects should be the Ministry of agriculture in the regions. On the specific investment areas it is advisable to prepare a number of alternative projects with reasoning the cash flows in the context of the necessary financial resources, types and amounts of budget support and loan funds.

Standard approaches to the assessment of the efficiency of investment projects (Ministry of economy of the Russian Federation, Ministry of Finance of the Russian Federation, State Building of the Russian Federation, 1999) should be supplemented with methods of financial management, enabling to conduct the instrumental support of the investment decisions.

One of the main evaluation methods of agricultural business can be a discounted cash flow method. Connecting the value of the future cash flows to the current point in time is impossible without calculation of the discount rate. In economic terms, the discount rate means the required by investors rate of return on invested capital of comparable risk investment objects.

The discount rate can also be defined as the cost of attracting capital from various sources (Russell, 2013). For the cash flow of the invested capital the discount rate is used which is equal to the sum of the weighted rates of return on the equity and borrowed funds, where the weighted rates are the shares of debt and equity in the capital structure (Marchica, Mura, 2010). This discount rate is determined as average weighted cost of capital (WACC). This figure is used when calculating economic value added (EVA).

Economic value added (EVA) is a method of measuring financial condition of the company, which calculates the real economic income (Dahl, Dobson, 1976). The main idea and meaning of EVA indicator is that the capital of the company needs to operate with that kind of efficiency, which provides an amount of profitability required by the investor or other owner on the invested capital (Sillano, Dios, 2005).

Economic value added is more likely to take place if for the given period of time it has been managed to earn a return on the invested capital higher than the rate of return of the investor.

The methodology of analysis of economic value added consists of several stages and includes a number of indicators.

1. The price of borrowed capital (РЗК):

РЗК = ПУ / ЗК х 100

where ПУ – interest to be paid, ЗК – borrowed capital

2. The share of borrowed capital in capital structure (dЗК)

dЗК = ЗК / А

where А – balance

3. The price of own capital (PCK):

PCK = R+bt × (Rm-R)+x+y+f,

where R – risk-free income rate, bt – risk of corporative investment on the basis of methods of the rating of the financial condition of the borrower, Rm – the average yield of shares on the stock market, x – the risk of investing in the industry, y – award for secrecy, f – the premium for country risk

4. Share of equity in capital structure (dСК):

dСК = УК / А

where УК – share capital

5. Weighted average cost of capital (WACC):

WACC = РЗК × dЗК + РСК × dСК

6. Invested capital (СE):

СE = А – КЗ

where КЗ – credit debt

7. Return of the invested capital (ROCE):

ROCE = ЧП / CE × 100%,

where ЧП – net income

8. Economic value added (EVA):

EVA = (ROCE - WACC) × CE / 100%

9. Spread of return (СД):

СД = EVA / СE *100 or ROCE - WACC

The calculation of indicators was carried out using the software package "Automated system for complex financial, economic and managerial analysis of economic activities of enterprises"(Schneider, 2015).

At the stage of evaluation of equity several intermediate iterations are carried out:

1. The risk-free rate of return is the rate on time deposits adjusted by inflation rate for 12 months.

2. The average return of shares on the stock market is determined as the margin between the market risk premium and risk free rate of return.

3. Estimated risk of corporate investments to the enterprises of the sector (the coefficient “beta” for the firms whose shares are not traded on the stock market) based on the methodology of rating the financial condition of the borrower. The obtained value of the index "beta" needs to be adjusted by a coefficient that characterizes the fluctuations amplitude of the total stock returns of companies operating in this sector compared to total stock market returns in general.

4. Risk assessment of investment to small enterprise is based on the value of the assets of the organization, as well as current liabilities on loans and calculations where the adjusted coefficient of current ratio is calculated.

- Findings

The degree of nominal risk-free rate was below the rate of inflation. In present conditions of Russia the value of the nominal risk-free rate based on yields of government bonds cannot be used in the discounted cash flow method. However, in the calculation of the weighted average cost of capital the negative value of the risk-free rate is acceptable (table 1).

Table 1. The analysis of factors of prices of own capital of farm enterprises in Penza region

|

Indicators |

2017 |

2018 |

2019 |

|

Risk-free rate of return |

2,17 |

0,09 |

3,37 |

|

Market risk premium |

8,05 |

7,4 |

7,4 |

|

Average return on the stock market |

5,88 |

7,31 |

4,03 |

|

Risk of corporative investment to the enterprises of the industry |

0,91 |

0,81 |

0,91 |

|

The adjusted current ratio |

1,253 |

1,432 |

1,265 |

|

Risk of investments to the small business |

0,35 |

0,32 |

0,35 |

|

Premium for secrecy |

1,63 |

0,07 |

2,53 |

Source: Authors' calculations based on the financial statements 220 agricultural enterprises of the Penza region

Investing in shares of Russian enterprises in the country is very risky because the risk premium exceeds the return of the shares on the stock market. The enterprises of the industry belong to the second grade of creditability. Thus, the risk of the investment can be evaluated as medium on the market and assigned the indicator "beta" value equal to 0,82.

On the basis of statistical data the fluctuation amplitude of the total-return from stock of the companies in the industry "the industry" in general for 2016 is 1 compared to the overall stock market returns.

The final value of the index "beta" according to the producers of the Penza region for 2016 is 0,91. The premium for secrecy from the risk-free rate accounted for 75% and equal to 2,53%.

Thus, on the basis of the conducted analysis it is possible to make a conclusion that the risk of investing in agriculture of Penza region can be assessed as high and assign it a value of 0,35.

At the final stage of the analysis there carried out the assessment of parameters of economic value added (table 2).

Table 2. Assessment of parameters of economic value added in farm business of Penza region

|

Indicators |

2017 |

2018 |

2019 |

|

The price of borrowed capital (РЗК) |

7,886 |

7,297 |

10,415 |

|

The share of borrowed capital in capital structure (dЗК) |

0,547 |

0,521 |

0,524 |

|

The price of own capital (PCK) |

9,35 |

8,83 |

9,78 |

|

Share of equity in capital structure (dСК) |

0,096 |

0,11 |

0,082 |

|

Weighted average cost of capital (WACC) |

5,101 |

4,748 |

6,564 |

|

Invested capital (СE) |

44882280 |

50872846 |

61113795 |

|

Return of the invested capital (ROCE) |

1,158 |

7,101 |

8,882 |

|

Economic value added (EVA) |

-1769637 |

1197172 |

1416337 |

|

Spread of return, copeck./rub. |

-3,94 |

2,35 |

2,32 |

Source: Authors' calculations based on the financial statements 220 agricultural enterprises of the Penza region

According to the table 2 it can be stated that cost of equity of farm enterprises in Penza region is equal to the average return of shares on the stock market, that is, the return for the owners can be determined as the average in the industry.

- Conclusion

The cost of borrowed capital of farm enterprise for the examined period significantly exceeds the cost of equity. So, credit attraction to the industry is not a rational step.

Measure value of weighted average capital cost is quite low that can demonstrate cost increase of this the entity in time.

In general for the examined period the invested capital and its profitability grow that is a rather favourable tendency.

For the interpretation of economic value added parameters, it is necessary to be guided by the following reasoning. The positive value of economic value added means increment of market value in comparison with book value of net assets and incentive for owners to perform further investments to the enterprise. Negative one – leads to decreasing of market value of the company and loss of the invested capital by the owners due to failure to obtain alternative return.

The research conducted according to the data of Penza region, indicates the increment of market value of agricultural enterprises over book value of assets in recent years and a positive tendency in this direction. So, if in 2014 owners lost the invested capital due to return loss, then by the results of an assessment in 2018 and 2019, it is possible to state about the existing incentive for an investment owners of additional resources to invest to the in business activity and business of this industry.

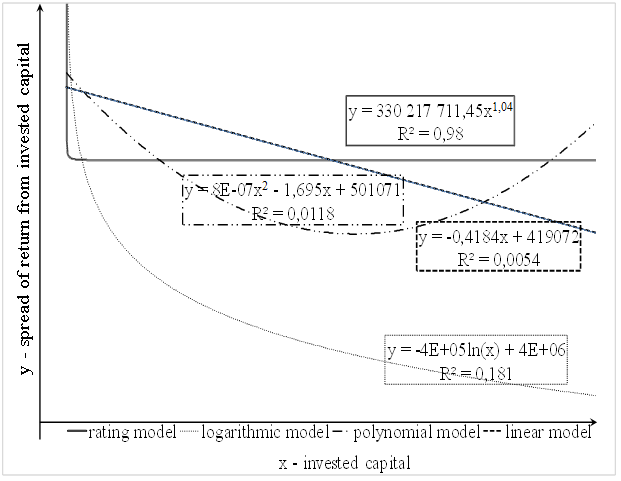

The yield spread shows that part of economic value added which is received for 1 ₽ of the invested capital. It shows how much market value of the enterprise will increase under the investment of additional resources. So, in the Penza region, each invested ruble in 2018 and 2019 led to the growth of market value of business more than for 2,3 kopeks. It will make possible to reason for the necessary amount of infusion into the real sector of agrarian economy under the certain market value of business (fig. 2).

Source: Authors' calculations based on the financial statements 220 agricultural enterprises of the Penza region

Figure 2. The models of dependence of the yield spread towards the invested capital in agrarian business

The trend analysis of the return spread from the invested capital which is carried out according to 220 agrarian enterprises of Penza region has shown the grading relation between the market value and the invested capital. With probability of 98% each invested ruble will promote growth of market value, and elasticity of model demonstrates that in case of increasing the invested capital by 1%, market value will grow by 1,04%.

Summarizing the results of the conducted research, it is possible to conclude that today there is a great variety of ways in the management of investment in agrarian economy in Russia. It should be noted the outlined certain positive changes and positive tendencies in this direction.

First of all the progress is connected with the growth of budget investments and involvement on this basis of resources of the banking sector under certain state guarantees. At the same time, the undertaken actions have not done enough to attract other investors yet and to attract their private capital into agrarian business. It is reasonable to prove the efficiency of potential investments, show the return from the invested capital and for that the instruments of investment and financial management can be most suitable.

1. Anastassiadis, F., Liebe, U., Mußhoff, O. (2015). Financial flexibility in agricultural investment decisions: A discrete choice experiment. Agricultural Economics Review, 16(1), 47-58.

2. Bespahotnyj, G. V. (2016). Financing of state programs on import substitution in agricultural industry. Economics of agricultural and processing enterprises, 1, 19-22.

3. Baryshnikov N.G., Samygin D.Ju., Tolmacheva N.P. (2018) Optimization of financial stability of agricultural enterprises in the region. Russian Journal of Management, 4, 6-10.

4. Cordeiro, J. J, Kent, D. D. (2001) Do EVA (tm) adopters outperform their industry peers? Evidence from security analyst earnings forecasts. American business review, 19(2), 57

5. Dahl, W. A., Dobson, W. D. (1976). An analysis of alternative financing strategies and equity retirement plans for farm supply cooperatives. American Journal of Agricultural Economics, 58, 198-208.

6. Federal law (1999). About foreign investments in the Russian Federation. No. 160-FZ is accepted on July 9, 1999 (an edition from 5/5/2014)

7. Federal law (1999). About investing activities in the Russian Federation performed in the form of capital investments. No. 39-FZ is accepted on February 25, 1999 (an edition from 12/28/2013).

8. Federal law (2006). About development of agricultural industry. It is accepted 12/29/2006 No. 264-FZ (an edition from 2/12/2015).

9. Gamba, A., Triantis, A. J. (2008). The value of financial flexibility. Journal of Finance, 63, 63-96.

10. Goncharov, V. (2016). Potential production of AIC: assessment and problems of development. Economist, 2, 77-85

11. Government of the Russian Federation (2014). The program of support of the investment projects realized in the territory of the Russian Federation on the basis of project financing. It is approved as the Order of the Government of the Russian Federation of October 11, 2014 No. 1044.

12. Jahangir, A., Darron, W., Gizelle, W. (2016). The value of financial advice: An analysis of the investment performance of advised and non-advised individual investors. Investment Analysts Journal, 45, 63-74

13. Marchica, M. T., Mura, R. (2010). Financial flexibility, investment ability and firm value: evidence from firms with spare debt capacity. Financial Management, 39, 39-65.

14. Ministry of Economic affairs of the Russian Federation, Ministry of Finance of the Russian Federation, State Committee for Construction of the Russian Federation (1999): Methodical recommendations about an efficiency evaluation of investment projects. N BK 477 are approved 6/21/1999.

15. Poshkus, B. (1979). Leveling- off the economic conditions of managing. Vilnius: "Mokslas".

16. Russell, L.A. (2013). Cost Efficiency and Capital Structure in Farms and Cooperatives. Unpublished Dissertation, Kansas State University.

17. Samygin D., Baryshnikov N., Shlapakova N. (2017) Models of investment appeal of agribusiness in russian regions. Ponte, 73(2), 344-351.

18. Schneider, L. I. (2015). Information technologies in an efficiency evaluation of management of finance on the basis of an indicator of EVA [Online], available at: http://1-fin.ru/?id=181. (Accessed 9 January 2018).)

19. Seleznev, A. (2015). About features and content of policy of attraction of direct foreign investments. Economist, 8, 3-11

20. Sillano, M., Dios, O. (2005). Willingness-to-pay estimation with mixed logit models: some new evidence. Environment and Planning A, 37, 25-50.

21. Wang, Y.-C. (2016). The optimal capital structure in agricultural cooperatives under the revolving fund cycles. Agricultural Economics - Czech, 62, 45-50. DOI:https://doi.org/10.17221/204/2015-AGRICECON