student from 01.01.2021 to 01.01.2025

Moscow, Russian Federation

from 01.01.2013 until now

Lyubercy, Moscow, Russian Federation

VAK Russia 5.2.1

VAK Russia 5.2.4

VAK Russia 5.2.5

VAK Russia 5.2.6

VAK Russia 5.2.7

UDC 33

CSCSTI 06.00

Russian Classification of Professions by Education 38.00.00

Russian Library and Bibliographic Classification 65

Russian Trade and Bibliographic Classification 7

BISAC BUS BUSINESS & ECONOMICS

The article analyzes the possibilities of using RegTech technologies in the system of combating financial crimes in the context of the digital transformation of the financial sector. With the growth of data volumes and the complexity of financial crime mechanisms, traditional methods of combating offenses are becoming less effective, which requires the implementation of innovative solutions. RegTech, which are automated technologies, ensure the optimization of regulatory compliance processes through compliance systematization, improvement of decision-making mechanisms and modernization of reporting. The article considers key technologies for comprehensive verification of participants in financial transactions, as well as their integration with biometrics and behavioral analysis. Attention is also paid to international RegTech platforms that ensure the interoperability of verification systems and compliance with global standards. In addition, the main problems associated with the use of RegTech in the system of combating financial crimes are considered, and solutions to the identified problems are proposed.

digital transformation, financial crime, compliance automation, regulatory technologies, artificial intelligence, financial security

Современная финансовая система характеризуется стремительной цифровой трансформацией, сопровождающейся появлением новых форм финансовых преступлений и усложнением механизмов их реализации. Трансформация финансового сектора, инициированная технологическими инновациями конца XX века, была концептуально обозначена в 1994 году тезисом Б. Гейтса о дихотомии банковской деятельности и традиционных банковских институтов. Данное утверждение послужило катализатором формирования нового направления - Financial Technology (FinTech), интегрирующего технологические решения в финансовую сферу. В современных условиях технологические инновации являются фундаментальным фактором обеспечения конкурентоспособности финансового сектора.

В условиях растущей технологической сложности финансовых операций традиционные методы противодействия правонарушениям демонстрируют ограниченную эффективность. Это актуализирует потребность в развитии инновационных инструментов регулирования и контроля, среди которых особое место занимают регулятивные технологии (RegTech - Regulatory Technology), появление которых обусловлено экспоненциальным ростом объемов обрабатываемых данных [1]. В данном контексте представляется целесообразным проанализировать возможности применения RegTech в системе противодействия финансовым преступлениям, что позволит оценить потенциал данных технологий в обеспечении безопасности финансового сектора.

В контексте цифровой трансформации экономики актуальность исследования данного феномена определяется возрастающими рисками финансовых правонарушений как на глобальном, так и на национальном уровне, что требует имплементации передовых технологических решений в систему финансового мониторинга. Развитие цифровых финансовых сервисов в совокупности с ужесточением регуляторных требований детерминирует необходимость внедрения RegTech как инструмента обеспечения транспарентности и безопасности финансовых операций [2]. Автоматизация регуляторных процедур способствует не только повышению эффективности противодействия финансовым преступлениям, но и минимизации операционных рисков участников рынка.

Регулятивные технологии представляют собой специализированный сегмент финансовых технологий, обеспечивающий оптимизацию процессов соблюдения регуляторных требований посредством автоматизации и цифровизации. Эффективность данных решений достигается через систематизацию процессов комплаенса, совершенствование механизмов принятия решений и модернизацию системы отчетности. Алгоритмизация процессов и конвертация регуляторных требований в машиночитаемый формат способствуют повышению качества контроля. RegTech-решения обеспечивают интеграцию трансграничных операций и формируют интероперабельную экосистему взаимодействия между участниками финансового рынка.

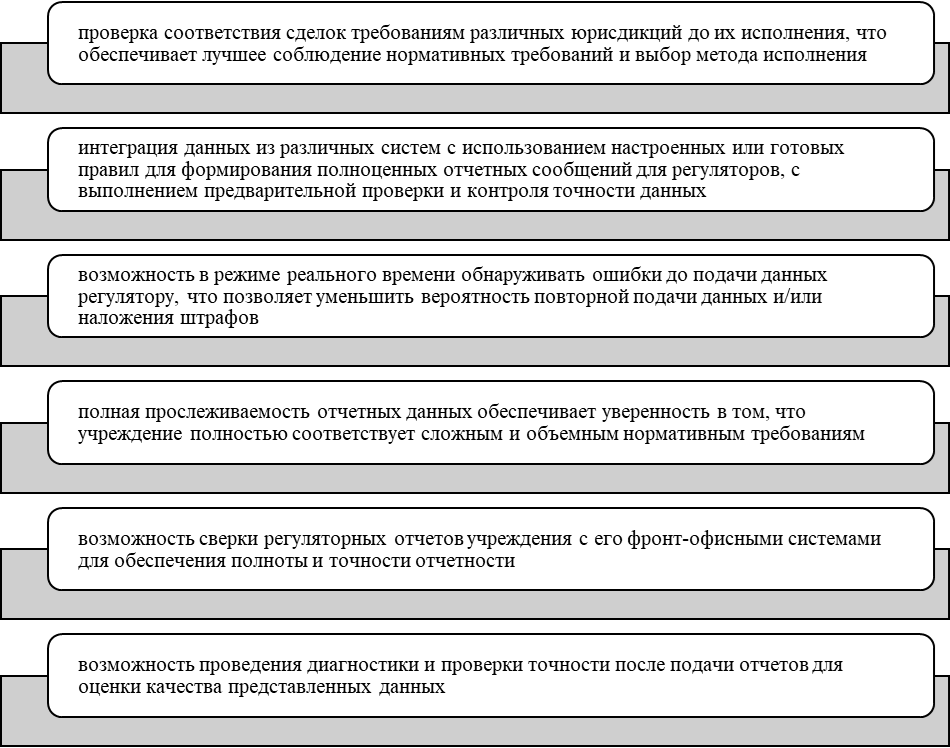

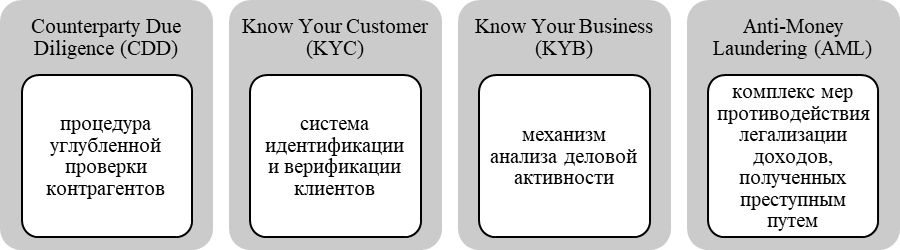

В соответствии с методологией Центрального банка Российской Федерации, архитектура RegTech-решений включает следующие ключевые элементы (рис. 1).

Рис. 1. Ключевые элементы RegTech-решений

Источник: Составлено авторами по материалам [3]

В системе RegTech-решений приоритетное значение имеют инструменты комплексной верификации участников финансовых операций, реализуемые посредством следующих процедур (рис.2).

Рис. 2. Процедуры комплексной верификации участников финансовых операций

Источник: Составлено авторами по материалам [4]

Данные процедуры интегрируют многоуровневую систему валидации субъектов финансовых операций и верификации источников происхождения капитала. Имплементация указанных механизмов направлена на минимизацию рисков финансовых правонарушений, включая мошенничество, легализацию преступных доходов, коррупционные действия и финансирование терроризма [6].

Эволюция стандартов KYC характеризуется экстраполяцией первоначально узкоспециализированных банковских процедур на широкий спектр экономических субъектов, включая нефинансовые организации и некоммерческий сектор. Современный инструментарий KYC и CDD интегрирует инновационные технологии биометрической идентификации (дактилоскопия, ретиноскопия) и поведенческой аналитики. Процедура AML представляет собой комплексную систему многофакторного анализа, включающую идентификацию бенефициарных владельцев и верификацию субъектов посредством сопоставления с санкционными списками и реестрами высокорискованных лиц [4].

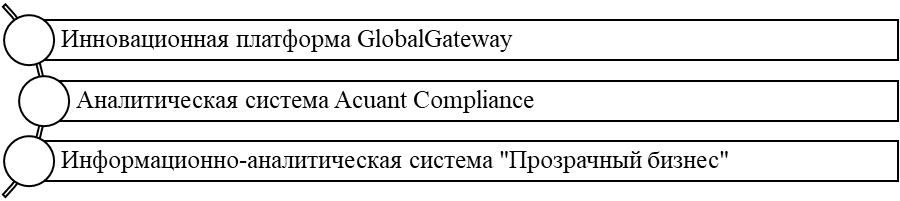

Для детального анализа практической имплементации RegTech-решений в сфере противодействия финансовым преступлениям целесообразно рассмотреть современные технологические платформы и инструменты (рис.3).

Рис.3. Основные инновационные платформы

Источник: Составлено авторами

В системе противодействия финансовым преступлениям особую значимость приобретают специализированные технологические решения, среди которых целесообразно выделить наиболее эффективные платформы и инструменты .

Инновационная платформа GlobalGateway, разработанная компанией Trulioo, представляет собой интегрированное решение для автоматизации процедур верификации в рамках KYC/KYB протоколов с имплементацией стандартов AML и CDD. Архитектура платформы базируется на Application Programming Interface (API), что обеспечивает интероперабельность систем верификации в международном масштабе, охватывая более 100 юрисдикций. Данная функциональность способствует существенной оптимизации временных затрат на процедуры валидации при сохранении высокой степени соответствия регуляторным требованиям.

Технологическое решение KYC-chain имплементирует комплексный подход к обеспечению соответствия международным регуляторным стандартам, включая GDPR, KYC, AML, CRS, MiFID и FACTA. Функционируя на базе глобальной партнерской инфраструктуры, система осуществляет верификацию документации в 240 юрисдикциях. Дополнительным функционалом является интеграция с базами данных санкционных списков и реестрами политически значимых лиц (PEP), что обеспечивает многофакторную аналитику рисков противоправной деятельности.

Аналитическая система Acuant Compliance реализует комплексный подход к имплементации AML-требований посредством интеграции множества верификационных механизмов: KYC, KYB, мониторинг санкционных ограничений и валидация финансовых транзакций. Дополнительной функциональностью является обеспечение соответствия требованиям GDPR. Несмотря на первоначальную ориентацию на банковский сектор и е-коммерцию, система демонстрирует потенциал для кросс-отраслевого применения.

В российской юрисдикции значимым примером KYC-решения является информационно-аналитическая система «Прозрачный бизнес», обеспечивающая интеграцию данных государственных реестров (ЕГРЮЛ, ЕГРИП) с расширенной аналитической информацией. Система агрегирует данные о корпоративных связях физических лиц, информацию реестра дисквалифицированных лиц и сведения о субъектах, включенных в списки налоговых органов повышенного риска. Данная методология обеспечивает комплексную минимизацию рисков контрагентов в аспектах финансовой состоятельности и легитимности деятельности.

Анализ практики применения RegTech-технологий демонстрирует дифференцированный подход к их имплементации различными субъектами финансового рынка. В банковском секторе наблюдается интенсивная интеграция инновационных технологических решений, направленных на обеспечение соответствия регуляторным требованиям. Приоритетное развитие получают системы скоринговой оценки на основе цифрового следа и механизмы альтернативного финансирования (P2P-кредитование, C2B-инвестирование). Репрезентативным примером служит коллаборация АО «Альфа-Банк» с платформой «Solar Staff», результатом которой стала разработка автоматизированной системы легализации трансграничных операций фрилансеров с интегрированным модулем налогового комплаенса.

В страховом сегменте ключевым направлением развития RegTech является трансформация подходов к обработке данных - переход от концепции «big data» к «smart data». Данная эволюция реализуется посредством внедрения когнитивных вычислений и алгоритмов машинного обучения. Технологическая платформа «Рекордсур» обеспечивает автоматизированный анализ клиентских коммуникаций с охватом до 100% взаимодействий (против традиционных 1-5%). Система «Интелледокс» реализует сквозную автоматизацию процессов комплаенса, а технология AIDA (Artificial Intelligence Data Analytics) осуществляет многофакторный анализ для выявления мошеннических схем.

Аудиторский сектор также демонстрирует системный подход к имплементации RegTech. Глобальная практика насчитывает более 260 специализированных решений, преимущественно разработанных в юрисдикциях с развитой регуляторной инфраструктурой (США, Великобритания, Ирландия, Люксембург, Канада, Нидерланды, Индия). Особого внимания заслуживают платформы Corlytics и ComplyAdvantage, демонстрирующие высокую эффективность в обеспечении регуляторного соответствия.

Отдельного рассмотрения заслуживает опыт техфин-компаний в имплементации RegTech-решений. Существенным вызовом является оптимизация системы детектирования подозрительных операций - необходимость балансировать между недостаточной и избыточной чувствительностью алгоритмов. Согласно исследованиям Thomson Reuters Regulatory Intelligence, доля ложноположительных срабатываний достигает 95%. Прорывным решением стала инициатива Google по интеграции искусственного интеллекта в систему финансового мониторинга, что ознаменовало отказ от традиционного rule-based подхода в пользу комплексного анализа транзакционных, клиентских и корпоративных данных. Эффективность данного подхода подтверждается опытом HSBC, где внедрение AI-based решений позволило сократить количество уведомлений на 60% при одновременном повышении точности детектирования в 2-4 раза [5].

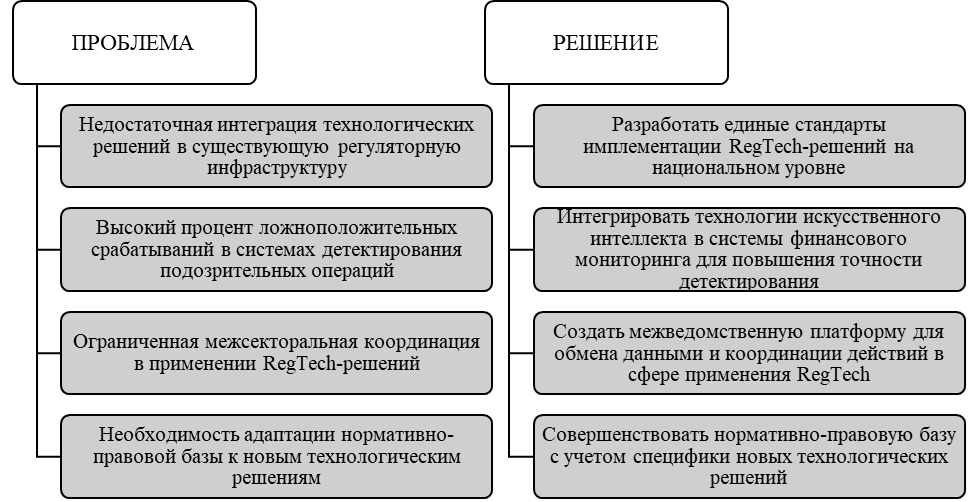

Исследование возможностей применения RegTech в системе противодействия финансовым преступлениям выявило ряд ключевых проблем и направлений их решения (рис.4).

Рис. 4. Основные проблемы и пути их решения применения RegTech в системе противодействия финансовым преступлениям

Источник: Составлено авторами

Реализация предложенных мер позволит повысить эффективность противодействия финансовым преступлениям и обеспечить устойчивое развитие финансового сектора в условиях цифровой трансформации.

Оценка тенденций развития RegTech позволяет сделать вывод о значительном потенциале данных технологий в трансформации системы финансового мониторинга. Синергетический эффект от взаимодействия регуляторов, поднадзорных органов и техфин-компаний создает предпосылки для формирования инновационной экосистемы, интегрирующей принципы этического регулирования и технологической эффективности. Имплементация RegTech-решений способствует повышению устойчивости финансовой системы посредством усиления механизмов контроля и автоматизации процедур комплаенса.

Дальнейшее развитие данного направления требует системного подхода на государственном уровне, включая разработку методологической базы и совершенствование нормативно-правового регулирования. Приоритетной задачей для национальных правительств становится формирование комплексной стратегии интеграции RegTech в существующую инфраструктуру противодействия финансовым преступлениям с учетом специфики локальных юрисдикций и международных стандартов финансового регулирования.

1. RegTech 101: What It Is, Why Now, & Why It Matters. — 02.11.2017. [Electronic resource] URL: https://www.cbinsights.com/research/RegTech-trends-fintech/

2. CB Insights. Regtech 102: The Evolution Of Regtech And The Future Of Regulatory Compliance. 09.01.2018. [Electronic resource] URL: https://www.cbinsights.com/research/regtech-four-phases-expert-intelligence/

3. The main directions of development of suptech and regtech technologies for the period 2024-2027. — Moscow: Bank of Russia, 2024. [Electronic resource] URL: https://www.cbr.ru/content/document/file/120709/suptech_regtech_2021-2023.pdf

4. Technologies for combating financial crime in 2024. // Plus World. [Electronic resource] URL: https://plusworld.ru/articles/58068/

5. Piskarev D.M. Digital regulatory technologies: essence, types // Bulletin of the Plekhanov Russian University of Economics. — 2018. — No. 1 (21). — P. 153–159.

6. Popova, A. V. 4.5. Internal control in the mechanism for combating corruption / A. V. Popova, A. E. Suglobov // Audit and financial analysis. – 2018. – No. 1. – P. 134-138.

7. Chumak, G. V. Application of the method of manual assessment of counterparties in combating corporate fraud / G. V. Chumak, A. E. Suglobov, E. A. Telkova // Russian Journal of Management. – 2022. – Vol. 10, No. 1. – P. 71-75.